Ready for the big No Spend Month disappointment? I totally succumbed to temptation at the thrift store this week.

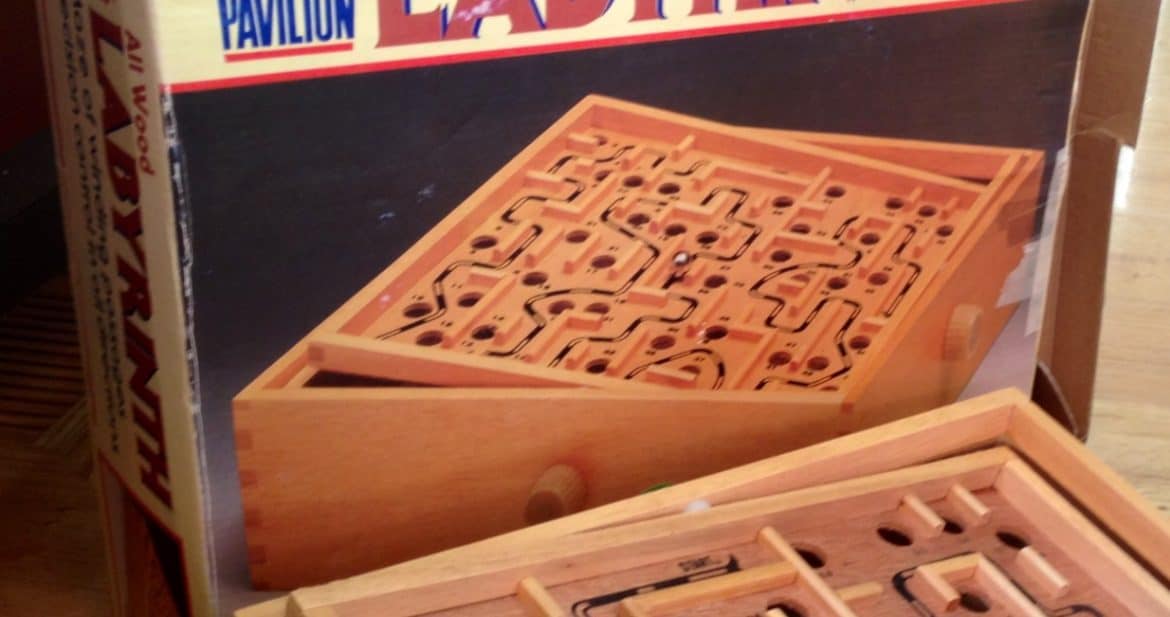

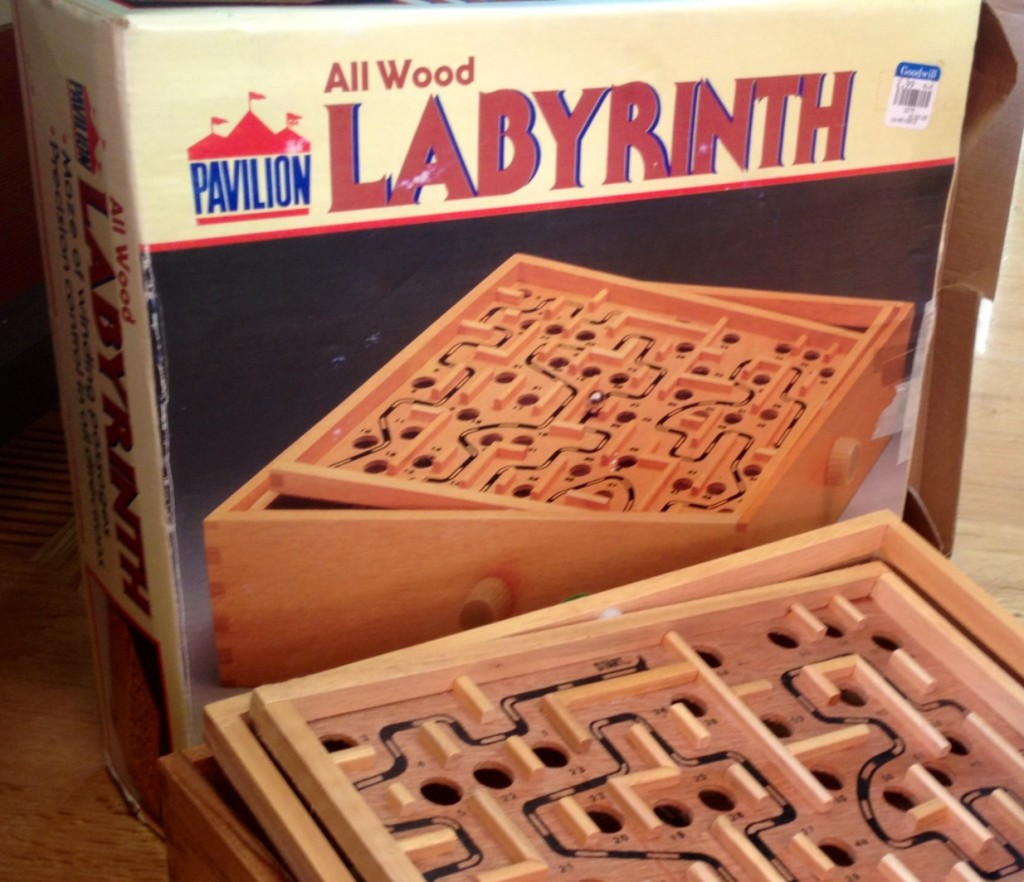

See, there was this mint condition, vintage, all-wood game of Labyrinth.

Remember trying for hours to get that little metal ball past the fourth hole in the board? Or was I the only one dorky enough to think this 3D maze challenge was awesome? This was even before Myst and Riven, remember – back before games were Apps. I have very fond elementary school memories of Labyrinth.

Anyway, my nostalgia button was pushed and I couldn’t say no to the $2.99 price tag. My daughter was immediately hooked and played Labyrinth for 2 hours straight. Three bucks? Honestly – totally worth it.

I also bought a mini Etch-a-sketch for $1.25 because, and let me be totally frank here, I was distracting my very cranky son from the $6 fuzzy lion hat he fell in love with and the Rolos at the check-out line. (Must they do that?)

Which brings me to my Lesson of the Week. During No Spend Month, do not go to stores to browse. It’s like “browsing” at the French pastry place with the amazing eclairs two-weeks into your new diet. Unneeded temptaion.

Personally, I don’t think I’ll have any problem staying away from stores for the next several weeks. First, I still cannot drive, so I’m limited to places within walking distance unless someone else takes me. Second, the thrift store (my first outing other than to the Opthamologist’s office in the nearly four weeks since my eye surgery) was mild torture.

There was too much motion, too many people, too many obstacles to navigate without effective depth perception. I felt like I was being attacked by discount jeans and Halloween wigs at every turn and was happy to skulk my eye-patched self back to the house. I tried to be brave and venture out but it really wasn’t worth it.

Except for Labyrinth.

Week Two Spending

Chicken Food – $17.51

Gas – $50.72

Groceries (Cheese & Milk) – $19.05

Board Game and Etch-a-Sketch at Thrift Store – $4.62

______________________________________

Week 2 Total – $91.90

Prior Week – $35.00

Monthly Total – $126.90

So, here we are about 40% of the way through the month and we’ve spend 50% of our alloted money.

I’m not too worried. This No Spend Month has been the easiest one yet. There is a good chance Homebrew Husband won’t need to refill his car again this month, and the chickens certainly won’t need more feed. With me house-bound and “grocery shopping” from a pretty stocked pantry there’s no temptation to drive or go out or tackle on any big projects so it’s very easy for me to be frugal at the moment.

How has Week Two gone for you? Are you feeling solid about your savings or worried? Has it been difficult to forgo your usual spending, or do you feel liberated by this challenge?

0

I didn’t have eye surgery, but I can get that dizzy, overwhelmed feeling in a thrift store or antique mall, too. Visual overload, to be sure.

We did ok. We successfully avoided restaurants. I spent a little more than I’d planned at the grocery, but still less than I normally would.

My full post is here. 🙂

Nice work, Annie. I have edited your comment to link out to your No Spend Month update post. It was going to the Bare Chicken Website. Let me know if that isn’t what you intended. 🙂

All I get is ads for Bare Chicken…definitely not interested.

How did I not pick up on your thrift store trip!? I am quite familiar with the ‘don’t window shop unless you actually want to spend’ lesson. Still, less than $5 is a small price to pay for child entertainment and a much needed (if daunting) outing.

My updates are a bit behind yours, but week 1 was a riotous success. Week 2 will be only slightly less so. And the money keeps rolling into the savings accounts. A wonderful feeling!

This rule applies to pet stores and shelters, too, I’ve heard. 😉 Nice to pack on some savings!

I think a “no spend month” is a good habit changer for a lot of people. Helps you confront all the myriad of things you just buy. Last time I went to the mall was for a wedding gift a month ago. Otherwise, it’s gas, occasional dining out, and groceries and things we need at Walmart. We’re saving 50 to 60 percent of net income most months. This is the point on the curve you want to get to. Once you are at a savings rate above 50 percent, things start happening fast. Debt disappears, then mortgage disappears, then pretty soon you are looking at investments such as SPY (S&P 500 index ETF) to park your money. Once you have about 25 times your monthly spend saved up, you are financially independent. A 4 percent per year withdrawal rate covers your basic expenses. This takes about 14-15 years at a 50 percent savings rate. Hint – it is much easier if your monthly spend is as low as possible.

I meant 25 times your annual spend rate.

Our first No Spend got me into a whole bunch of eco and frugal habits like cloth napkins and DIY yogurt that have stuck with me. It’s kinda like boot camp for the old frugality muscle, right? 🙂 I am a big fan of debt-free. But I think Ien (below) makes a good point. While it is certainly possible to save, say, 70% + of your income on a $30K a year salary, the remaining $9000 a year to live on independently is hard poverty by anyone’s definition. (I say independently because 9K was actually my annual budget when I was in college and I didn’t suffer a bit, but certain things were subsidized by my status as a student – like health care, utilities and some of the on-campus food options.) Saving an equivalent 70% when you make $130,000 still leaves you with $39,000 of “living money” which is right around median income in the U.S. for full time workers and gives you a “lifestyle” that is solidly middle class. So while I adore MMMs advice, I think it’s important to keep “70% of *what*” in mind and be mindful of ways to grow the pie at the same time you are trying to trim the fat, if you’ll excuse the mixed food metaphors!

Leaving Labyrinth at the thrift store would have been a false saving., right? So worth it. @Kenneth: nice advice but how does it work for people on the edge?

Well, I suppose if I’m $3 over at the end of the month we’ll know it was false spending. 😉 I’ve shared some thoughts on high-savings goals as mentioned by Kenneth above. I think they are fantastic and Homebrew Husband and I are working to get towards savings numbers like Kenneth. But the starting income is pretty dang important when you are figuring out how to live on 40% or 30% of your pay and it’s just going to be a lot more pleasant for moderately high-income earners to trim to that savings percentage than it is for people in the first or second quintile of income.

Total score on the game! I played that as a kid and loved it!

To be honest, this has been really tough for me. I’m hating it. And I’m hating that I hate it because I usually love this kind of thing. I’m not sure why it’s been so difficult for me this time around. Maybe I just set really unrealistic expectations for us this month?

Advice and encouragement is appreciated! Here’s my update: http://lazyhomesteader.com/2012/10/12/no-spend-october-week-two/

You can do it, Anisa. And you know what? If you are over a little bit at the end of the month, you are still UNDER compared to typical spending, right? I blew through my budget last No Spend July because I couldn’t say no to seasonal strawberries. It was the right decision – we’d have been upset if we’d had to go all winter without frozen strawberries, but it still sucked to feel like I’d missed a goal. But hey, I think you are doing great. Keep it up – the chicken’s won’t need more food for the month and I bet you can stretch your food like crazy for the next 2.5 weeks. Just do your best and see if you can squeeze a recurring bill like the phone or something down a few dollars a month – that savings will keep paying back even after NSM is over. You rock. XO.

I think Erica – that you are fast becoming my favorite (and I really mean FAV-O-RITE) blogger…

I mean gardening, saving money and labyrinth?

Thanks so much Bella! That’s a huge compliment! I’m glad to have you reading. You should be warned, though, that I’m super dorky in other ways too, not just Labyrinth. 😉

I am having an outstanding month—the husband is out of town on business for 2 weeks and we leave 14 miles from town. SO, I am just not going anyplace for two weeks. I talked the boss into letting me telecommute every day this month, instead of just 2 days a week. I am eating only from the cupboard and freezer (running out of milk is the only hardship so far, and that is a lot consdiering how much I love milk!). I am not clicking onto Amazon and I am reading my newspapers on line. So far, I have spent zero this month except for the usual fuel delivery and to help keep that low this month I am only turning on the heat for an hour when I get up and an hour before I go to bed. Living in interior Alaska, I am not sure I will be able to keep that up all month, but I will as long as I can. This was a good kick in the pants for me.

Woot! Woot! Great job. Sounds like you and I have the same plan – don’t leave the house, stay off Amazon.com, save money, do fine. 🙂

I did okay. Much better than last week for certain! I spent $40.00 on groceries because I couldn’t pass up some of the stock up deals and we needed fruit and milk. I also sold a few belongings to make some spending cash for the older girls’ volleyball games. I didn’t want to take away from my main budget and account for the no-spend month. The crazy thing is that I made $20 and it is still sitting in my pocket! Other than gas, I have not spent anything in the last week.

This is what I did to save money last week: http://livinglifeinruraliowa.blogspot.com/2012/10/monday-frugality-update_8.html

Love the spelling of your name – very chic. 😉

Way to go earning extra money rather than blowing off the challenge! Birthdays are hard to deal with during a big savings push – you don’t want a kid to feel like their day isn’t special just because the fam is thinking frugal. Sounds like you handled things wonderfully! We have a bunch of family bdays that come around in June which is why I sometimes do a summer NSM in July, to balance it out.

I just got a loaner car that I’ll have for two weeks, and it turns out that this really messes up my spending. I knew I’d spend more on things like food to stockpile and a few planned big purchases while I had it, but it also makes it really easy for me to go out just because I feel like it. Today was kind of rough, and it was really easy to head over to the thrift store to browse for a bit and to go to the restaurant we’d been wanting to try for dinner. It’s not the end of the world, but it’s interesting to see how much the convenience increases my spending. I keep telling myself that, if nothing else, awareness is a good thing, and a good starting point from which to work from.

I so agree about avoiding temptations, thrift stores, farmers’ market and quaint cafe shops where they serve lovely coffee and cakes 🙂 Last week I went to a local organic produce festival and I spent more that I usually do in a week and even a month. 4 Euros on one single fat porcini mushrooms! Atrocious.

This week was successful apart from having to buy anti fleas and mites drops for my cat Luna; they are quite pricy at 23 Euros for three doses! Well, at least November and December are covered now. For week three I’m going to be ruthless 🙂

See week 2 in my blog

Hi Erica- these posts are wonderful! I started a new job two weeks ago, so haven’t quite figured out what my monthly income will be. I’m still working freelance on the side, tidying up the rest of our finances and doing background reading on finances in general. When the paychecks become regular again I can play along, although that may be in November! There are so many great blogs, articles, calculators and reader tips on this topic- what a smart bunch of people!

My financial success of the week was receiving a check for items sold the consignment store, which I consigned in June. This check came on the same day a physical therapy bill was due (for a spring injury). The consignment store check was EXACTLY the same amount as the bill, which was easy on the mind and checkbook. Motivation to clean out the closets again and patiently wait for another few months…

Some friends of the family had Labrinth when I was growing up and I used to spend HOURS playing that game! I succumbed at the the thrift store, as well, but otherwise I think I did OK this week. http://packofhungrysnails.blogspot.com/2012/10/no-spend-october-week-2.html

The trick to hole 4 is go fast and straight down – after you get the little jog out of the way. Ask me how I know….

Labyrinth is cool. I had a similar maze called Monster Maze. Hours of fun.

Was wondering if you had any luck saving seeds this year? I have found seed saving to be a big money saver. This year I only bought a couple of seed packets. I have saved seeds from a couple dozen varieties of flowers, herbs and veggies. At $2-$4 a packet I figure I save upwards of fifty bucks in seeds and starts. I end up with more seeds than I can use myself and give excess to friends and neighbors.

We having been doing better since I wrote my week 1&1/2 wrap (http://kayoz.typepad.com/blog/2012/10/october-is-no-spend-month-first-status-report.html) – looking at what is actually in the cupboard and making up meals out of it, rather than buying ingredients we think we need. Mostly. I still haven’t done a proper audit though.

I *was* inspired to spend an hour in the garden this morning to get more seeds in the ground (and an old clam shell sandpit now mini-vege garden), so that we will have more food in the garden soon 🙂

This whole challenge has really got me thinking more about our budget again. Like, if we suddenly had to live on half our income, how would we go. We *could* do it. We wouldn’t end up homeless, though we may have to give up stuff we really don’t want to like health insurance (we have socialised medicine in Australia, but having private health insurance covers things like getting the surgery you just had with a private doctor instead of going on a waiting list to have it publicly, and also things like osteopathy and herbalism and dental), and would very possibly end up compromising some of our values in the grocery store.

But, it’s an interesting exercise to think about it.

At the start of the month after giving in to my 5 year Oldsmobile *Need for more toys and splitting on sushi, yet again….I felt like I was still spending (not as much as the previous month). Still determined, I kept focused on using what we have (in the pantry as well as the garden) because I’m determined to save for the eclipse festival in Queensland Australia next month….I was delighted when I was offered more work, which has made up for the $ already spent. Then yesterday we found out that we got approved to run an art workshop in the kids village at the festival….which means we get free tickets!!! A savings of $720.00 right there!! Thanks for setting the no spend challenge Erica. I’m feeling even more motivated to save. 🙂

Lol! Stupid predictive text; that was meant to say: my five year old son’s …which it still want to phrase as Oldsmobile.

No Spend has been a complete failure here. Because I’ve been ill, I didn’t put away nearly enough food this summer and hadn’t shopped beyond what we needed right then, so the only stockpile I have left is flour and tomatoes, as we’d already been using up what we had. Unfortunately, the thing causing me to be sick was that wheat flour, so using that is right out now. Between it being peak apple and pear season (and thus the bulk purchase and canning thereof), replacing breakfast staples and flours for pasta with gluten free choices, and the sudden spike in gas and food prices, we actually spent MORE than before for less food. We bought no extras whatsoever, and so far have no money left over and no savings. We are 2 weeks in and already spent the No Spend limit we set for ourselves for the month, which was a generous amount. I’ve even been being crazy with coupons and only buying sale items, to no avail. The only way I could make No Spend work at this point for us and cut our budget down would be to start using conventional produce and meats. I already gave up my raw milk for “regular” organic milk, entirely stopped buying chocolate, and switched to store brand coffee (which is apparently yuck). Considering how weakened I am from eating something I was allergic to for years, adding pesticides seems stupid. If you have any ideas how the frak I can cut down my spending, please share them because I’m totally out of them.

I realize that post might have come off whiny, or like something from a total food snob. I swear I’m not. I’m just very careful about what goes in my body. I am asthmatic, have autoimmune thyroid disease (hypo), a pretty nasty wheat allergy, serious chemical and dye allergies (hello hives/anaphylaxis!), and issues with my female organs and hormonal systems. These things result in having to watch every bite that goes in my mouth, such as NO soy, NO wheat or gluten, NO preservatives, NO dyes, and avoidance of anything that could contain artificial hormones, by medical orders. My daughter can’t have these things either, so working around it has been expensive. I cook from scratch in all things including the brown rice pasta because that’s our safest option to avoid contaminants, if that helps you to know where I’m at. I don’t want sympathy at all, but if you’ve got real help to offer I’m listening! Maybe I just picked a terrible time to try implementing No Spend. Maybe I’m doing something wrong. Maybe this is really how much I must spend to get by with such a teeny tiny garden because I live in such an expensive area (because of the much loved career my hubby has). I just want to pare my grocery bill down by $200 per month. We do want out of the L.A. suburbs, want to go back to the midwest where cost of living is sane. It’s just not happening now with no new openings in his field, and we’re trying to cope with bills AND have something left to save. We cut cable, paid off the car, wiped out some debt, and have been very careful with “extras”. I should count my blessings that we’re afloat, but the thought that missing one single paycheck will sink us is terrifying.

It may have been hard for you but it was certainly funny to read!

This was in response to Anisa…BTW

Thanks. 🙂