Everyone who talks about budgeting beats up on Starbucks and people who just want a damn cuppa coffee to help them get through their long, long day.

Poor Starbucks. Poor Latte Drinkers. I get it. I live in Seattle, where we love coffee, we love Starbucks, and mostly we love to pretend to hate Starbucks but then go there anyway. Coffee in Seattle is kinda like Church in Salt Lake City or Birmingham – you just don’t trash talk it.

Some of my readers, when I announced No Spend Month October by suggesting you could skip the latte and pay off your house were a wee defensive of the coffee habit. “Lay off my latte!” “Stop picking on lattes!” “Coffeeshops employ people!” “I have a kid I need my coffee break!” were a few of the understandable reactions from readers.

I get it. Me and my pot-of-homemade-coffee-a-day habit get it. Truly. No one on this blog is going to try to talk you out of caffeine.

All I ask, if you are white-knuckled as you read this, gripping the little paper sleeve around your mocha ever tighter and anticipating the rage that will fill you when yet another jerk tells you to give up your one…teeny…thing, the only thing you do for yourself….all I ask is that you finish your coffee so you don’t get a headache, and then hear me out.

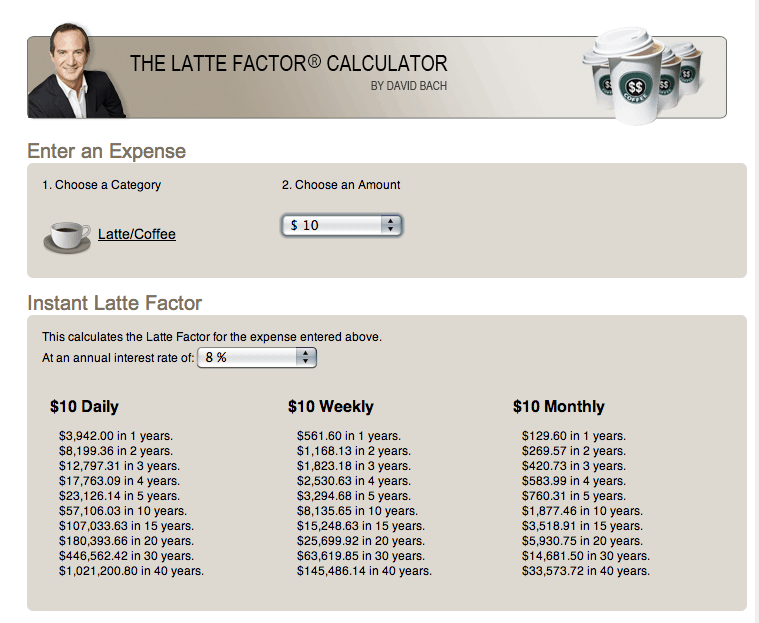

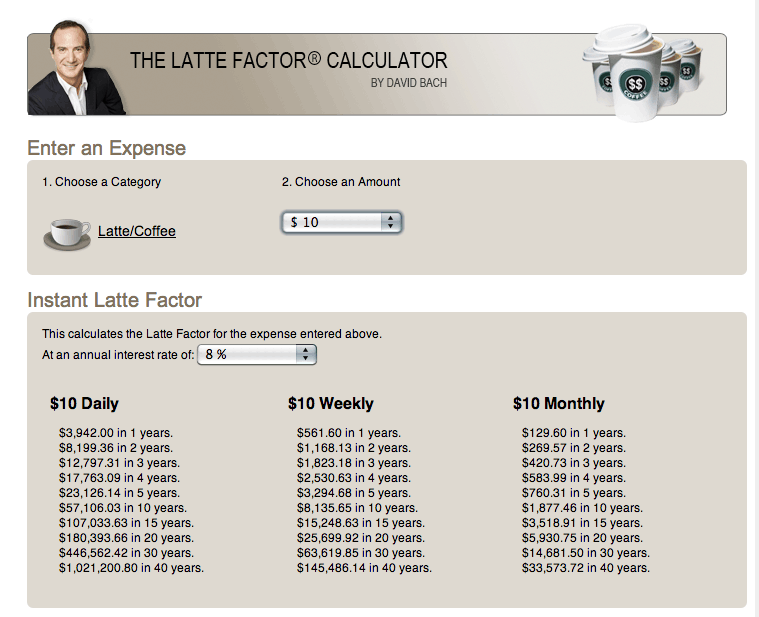

The reason Starbucks gets such a bad rap is because a financial writer named David Bach (author of the hugely successful Finish Rich series of books) coined the phrase “Latte Factor” to describe how small daily or weekly expenditures add up to big sums over time.

Bach, in his books and seminars, politely smacked people out of their habituated belief that a $4 or $10 a day latte habit wasn’t much money by showing them what that same amount of money can do if given room to grow and compound and breed more little dollars.

As it turns out, a $10-a-day coffee habit, indulged from the time you are 20 until you retire at 60, costs you over a million dollars.

But, this is not about the latte.

This might be about the latte, or it might be about the thrift store indulgences, or the mascara, or the iPhone Aps, or the garden store purchases (ahem, cough, cough) or the daily $7 lunch out, the weekly mani/pedi, the extra sleeve of Titleist Pro V1s every month, the Friday happy-hour cocktail, the extra bag of black oil sunflower seeds for the chickens or the weekend long-drive that burns $20 of gas.

Only you can assess what your little Money Leaks are, and only you can decide if those leaks are worth keeping. That’s where your values come into your spending.

But before you decide if the proverbial (or literal) latte is worth it, when measured against your spending values, you have to find out what it’s really costing you.

Today’s Mini-Money Challenge

Go to David Bach’s “Latte Factor” calculator to determine the true cost of those little treats you enjoy. Just pick one little Money Leak and factor it out. I recommend using an interest rate of 8% when you do the math – this is a typical, long-term average return for investments.

If you want a very conservative, worst-case-except-Zombies estimate of what kind of returns you might expect if you invested that money instead of spending it over 20 or so years, use 4%. This is a bare minimum of what your must-have little treat is costing you in opportunity cost.

“‘Opportunity Cost?’ I thought it was Latte Cost?”

In simple terms, opportunity cost is a fancy way of saying “ways you didn’t choose to utilize your resources, but could have if you’d made different decisions.” Opportunity cost isn’t just limited to money, it can apply to any limited resource: time, land, anything which, when used, tends to precludes alternate uses.

So, for example, the opportunity cost of growing a big garden is not having room for a pool. The opportunity cost of watching a two hour movie is the additional sleep you did not get. The financial opportunity cost of a $7 pack of cigarettes every day is whatever else you could have spent that money on, including savings. (There is another opportunity cost in health if you’ve got a pack-a-day habit, but that is slightly harder to quantify).

Just let “opportunity cost” sit with you for a second and allow yourself to own the fact that you are choosing to spend on your Money Leak. No one is making you choose latte or new shoes or golf balls or tomato starts over savings or a new bathroom or a paid off house or an iPad. These are your active decisions. You control them – isn’t that a powerful feeling?

So go look up what your little daily or weekly Money Leaks are really costing you over 10 or 20 years and then come back and lets talk about it.

(EDIT: several readers have let me know about security warnings that occur when they attempt to access the Latte Factor Calculator. While I have not encountered this, you can use this alternate calculator, enter the weekly amount your Money Leak costs and other relevant info and get the same info.)

You may look at the opportunity cost of a daily latte and pumpkin cream cheese muffin and decide that cost is completely within your spending values because $7 is how you buy yourself a few hours of peaceful, productive time every day. Or, you might be a little horrified that you just spent your kid’s college education and 640 calories a day on something you barely notice.

Let us know in the comments: what is your Money Leak? Are you just fine with your Money Leak spending or kinda shocked? Is that expense totally worth it for you? If so, awesome, it sounds like you are spending your money in accordance with your values! If not, what action will you take to plug that leak and to what will you apply your savings?

1

FYI: each time I click the link to the Latte Factor site, my antivirus pops up to tell me there’s a security breach.

For me, my budget is really stripped down. We save (or reduce debt with) 1/3 of our take-home pay each month. When I compare, say, eating out once a week ($30-35 for the two of us) to the impact of saving that money instead, there’s no question: it’s worth it to eat out. If I denied myself that treat three out of four weeks in a month, I’d be able to save one month’s house payment. Reducing my debt obligation one month is not worth grumbling and feeling denied my weekly date night three-quarters of the year.

Also – I use much lower interest rates for these short-term calculations. If I save $1000 by not eating out this year, that money’s going into a) my mortgage (4%) or b) my savings account (1.5%).

Thanks for letting me know. I’ve edited the post to include an alternate compound interest calculator you can use.

I bought a Keurig and a Vita-Mix. Great plain or flavored coffee, and when I need a treat, Frappe Mocha! Initial investment was under $500 and both machines seem pretty sturdy.

$8 per day Starbucks habit x 365 = $2920.

Yup. For a while we had a total hippie espresso machine – the kind that makes lattes at the push of a button. We had someone once ask us how we could afford it (it was an expensive up front cost!) Our feeling was: how could you NOT afford it, if you were drinking multiple fancy-pants espresso drinks per DAY, as is quite common in Seattle. It lasted about 10 years until we just couldn’t keep it limping along any more.

This is exactly what my dad did- he bought a super fancy one and based on his and my mom’s coffee drinking, he calculated that it had paid itself off in 3months. I originally bought a $5 espresso machine at the thrift store- the king you have to watch and turn off at the correct time…. but that one paid for itself in ONE DAY. But I have to tell you, the first cup in the morning was tough!– My dad then got me a fancy one for Xmas a couple years ago, and I love love love it. I’m still too lazy to froth my milk though, so I do what I call a poor mans latte- milk in the microwave with a shot of espresso (or coffee). YUM! Don’t you take my latte away either! I still have a latte at a coffee shop on occasion, but it’s either a treat or I’m traveling. This by far, has been the simplest way to save money and not give up anything (except for waiting in lines and sometimes crappy service).

I would LOVE to know where I can find this guy’s 8% consistent compounding apr. That is what always puts me off of these calculations. Sure, these little amounts add up. Sure, you might average 8% over the life of your investments. No, you are not going to be getting compounding 8% returns starting the first day you put your five latte bucks in an investment account. Not dissing on cutting out the small things, but realistically, we aren’t going to become millionaires this way. I am enjoying your mini money challenge posts, though, thank you!

Not consistent – average. 🙂 Yeah, I agree that you will not find a consistent compounding 8% return. Well, you might, but that’ll be when inflation is at 7% so your effective rate of return will still suck. 😉 For this kind of calculation the assumption is that you’ll be investing in broad base equities and for that assumption, I think 8% is probably still a reasonable 30-year average return. S&P 500 is at about 8.5% for 10-year returns even with the huge loses from the Great Recession. But ultimately, I think this more about thinking in terms of prioritization and thoughtful, values based spending rather than denial. Thank you for reading!

I get the same anti-virus message as Emily, even if I try to access it through the Finish Rich website.

Coffee isn’t a factor here; we drink coffee at home, but rarely buy it in a coffee shop. My husband and I both have a garage sale habit. That can be a good thing or a bad thing, depending on what we buy and why we are buying it. The opportunity cost is not just money that could be saved or spent in a different way, but space (to store the stuff we buy) and time (to maintain what we buy). On the other hand, we enjoy going to sales so much that it’s probably worth the opportunity costs.

Eating meals out can sometimes be an indulgence that gets out of hand for us. When it starts seeming out of sync with our budget, we rein it in for a while. We recently went out (husband, granddaughter and myself) and spent $70 on a very mediocre meal (national chain, casual sit-down place). That made me both sad and angry, because I could have made a much better meal for much less money at home — I just didn’t feel like cooking that night. Other times, a good meal out is worth every penny. We’re now going to try to limit restaurant meals to just one a month, making a point of going where we really enjoy the food.

I’ve edited the post to include an alternate compound interest calculator you can use.

I agree with you about meals. I love food, cooking and eating but we very rarely eat out. When we do, it’s really more about buying a service experience, because with two kids in tow, we rarely go to places that make food better than I make at home. Spending $70 or $100 on easy-meal dining stuff like spaghetti or burritos or a simple steak drives me nuts! My favorite dining out experience lately is a great Indian buffet brunch place up the road from us. For about $10 per adult it’s an entire buffet of really excellent Indian food, good atmosphere, nice service – and food that I love to eat but do not typically make at home, so I appreciate the variety it adds.

We seldom eat out here as we prefer our own cooking over what is available. This is small town midwest here and there are good restaurants, but none are vegetarian or vegan and very few are ethnic. Yes we have Mexican, Italian, and Chinese but really, I do a better job. Now when we go on vacation we eat out ALL the time it seems, like in New York City or San Franciso or the 2 times we have been in Seattle, or Quebec and Vancouver, for example. Then we have just a cornucopia to choose from, including vegetarian and every persuasion.

So I prefer to put my money into good ingredients and spices and cheese and good coffee to grind and lots and lots of kinds of tea.

You write so nicely, Erica, great post!

You know I am a MMM reader also. Couple of things he would say:

If you are still working, or still have debt including mortgage debt, any expense outside of required to live needs to be looked at. Including and especially repetitive expenses such as coffee out or dining out.

He tries to get us to a savings rate of 50 percent or more of our take home pay.

He would say that your debt, if any, is a FINANCIAL EMERGENCY that requires emergency habit changes to work out from under.

All of this being said – we average eating out once a week. No more, no less, but it’s kind of a nice treat we can’t live without. However, I brown bag my lunch to work and spend zero out of pocket every work day (except to fill my car with gas when required). We have free coffee at work, and if I didn’t, I’d bring my own coffee maker etc. At home, we make our own coffee of course.

Thanks Kenneth. 🙂 Nice to welcome fellow MMM readers. That site is awesome – great community! I’m definitely not hardcore Mustachian yet and have no right to face punch anyone (The SUV in the driveway will attest to that). 🙂 My take is a little more values-based because many of my readers have pretty strong feelings about, for example, supporting local farmers or moving toward self-sufficiency that may take precedence for them over the earliest possible retirement/financial independence. But I think one of the reasons MMM appeals to people is because so many people don’t actually realize that they can live their values and move aggressively towards more financial security simultaneously. Spending gets habituated and we stop asking why we are spending on certain things. That’s what this No Spend Oct. is all about – breaking out of that careless, thoughtless spending. Personally, I am beginning to recognize that a more self-sufficient-ish lifestyle may actually require FI and a more diversified income stream – what I’ve referred to as an “income quilt” – patching together earnings from many different areas to form a complete financial “blanket.” That’s what we are trying to achieve right now.

I just found you a few days ago and am excited to have some guidance. I have to say our only debt is mortgage and a school loan, so we are in a better place than most. Our major goal is to be debt-free SOON….your posts are helping me think this through because we kind of think of ourselves as working from a strict budget and we are, BUT we buy unnecessary “stuff” and stay within budget….my new goal is to cut the spending so we never reach the budget and have more to save each month.

My own foibles: lunch out once a week ($400 a year), magazines (oh how I love their glossy pages and lovely photos…best estimate: $100 a year), soda and candy (estimated at $400 a year). I sneak those last two into the basket at the grocery store which is skewing our grocery budget.

Thanks to this post I’ve spent my morning crunching numbers and facing my own spendy ways (such as they are). I just “found” $900 (see above). THANKS!

My husband likes to think about savings like you found this way. “If my boss just told me I was being given a $900 a year raise for no additional work, how would I feel? I’d feel great!”

My credit card is a miles card but you can exchange miles for magazine subscriptions. If magazines are a big indulgence for you, you might see if you can get them for, essentially, free. As long as the card is being used only for good, budgeted stuff anyway and you pay it off in full every month you might be able to game the system on that one. 🙂 There are also a lot of sites that specialize in super discounted magazine subscriptions you might look into.

If debt free soon is your goal, you know about http://www.mrmoneymustache.com already, right? Great job!

Monthly Fees are our money leak. We live on a very limited income with no credit cards (income is too low to qualify) making unplanned large dollar purchases (usually due to putting off things we couldn’t afford in the first place) results in a cash advance. Until that advance is completely paid off it eats $1 for every $10 advanced. It is our plan to pay it off, then keep paying it off..to ourselves. We are getting there slowly but surely.

Ooof. That’s tough. Cash advance loans are usury, pure and simple. Good luck to you in figuring out the right path to getting out from under them. I know you can do it.

I think, for me, the problem is not that I don’t *know* that I could really be saving a lot of money by getting my “leaks” under control, but that I’m always able to justify them – at the time. I end up with a lot of buyer’s remorse.

Right now, we’re $45 over budget for the month, and that’s not a lot, really, but I remember back when I was a college student and $45 was a significant amount of money (and I’m not, like, really old, like back when a loaf of bread cost a nickel. I’m lived-through-the-80’s-and-loved-them old) , and in fact, losing $10 once put my whole budget in a tailspin and I almost got evicted. So, that $45 is pretty significant – intellectually and logically – but when I’m in the thrift store and I see a Stephen King novel (it’s only $2.99!) that I’d like to read, but don’t, yet, have, all spending logic goes right out the window.

I’m working on it … but it’s definitely going to take some conscious effort :). Thanks for the challenge ;).

Yes, the spirit is willing but the flesh is weak. I understand. But I think this kind of stuff gets easier with practice if you just keep it up. That’s why I like No Spend Months so much – they force you to break away from spending on the stuff you’ve stopped even thinking about.

I spend way too much money on food, but it’s supposed to be what’s best all around. Local, sustainable. lately, I have been spending an extra dollar or two to make sure I’m not buying food from companies that support No on Prop 37, it seems pretty frivolous though. I’m always looking for good tips on how to save money. I’m even thinking about making my own laundry detergent and dishwasher soap.

I spend way too much on food too (or supplies to grow food). I’m a big fan of growing your own when possible of course, and particularly of growing those things that are expensive to buy from ethical sources in the stores. Berries are definitely in this category. They are easy to grow (or glean) in the Pac NW and VERY expensive to buy organically. Making more from scratch helps get you away from food “manufacturers” too but there is always a time-money-ethics tradeoff. You’re going to have to give on one, I’ve found. 🙂

I’ve cut back on most things, but my biggest leak is thrift store purchases, and especially books. I don’t get to the bigger thrift store all that often now, but I have a weakness for cast iron pots, wool blankets, vintage pottery, and hand knit sweaters, and I find it pretty easy to justify them. I do, however, live just down the street from a used bookstore that’s run by a thrift store. I probably average $8 per week between the books and other thrift store purchases. I wouldn’t mind cutting it back a bit – any money saved is good – but given that it’s not a lot, it’s pretty much my only vice, and I really love books, I think I’m mostly okay with it.

This is exactly what I mean by values-based spending. It’s not about giving up everything you love – it’s about evaluating if you really love what you are spending on enough to prioritize it. Sounds like your book habit falls into the category of spending that is in line with your values and within your budget and that’s fab. Just one question, though: are you equally close to a library? If you wanted to, could you get the same new-to-you book experience for free there? 🙂

I am, and I could, and I do for some things. I have cut back recently, and have been ordering books that I don’t think are necessary or worth rereading from the library rather than buying them. I really justify my book habit with two things. First, I read in such fits and starts these days that I rarely get to finish anything before it’s due, so I like to have a copy I can read at my leisure . Also, I really like the idea of building my own library – libraries seem to keep losing funding, there’s already a fair bit that my city library doesn’t have, and it’s oddly comforting to know that I have my own books for reference and entertainment right here. Or…maybe I just really like books and these are convenient excuses. Nah…that couldn’t possibly be it… ; )

My main “latte cost” is postcards and postage. I participate in international postcard exchanges, have several pen-pals, and send photo postcards of my daughter to family every month. The cost of the card and postage is less than $2 for each one, but it adds up to at least $20 a month. Luckily things aren’t tight enough that I have to give up something I enjoy so much 🙂

A friend recently sent me the link to your blog and I’ve enjoyed reading through the archives. I have also recently found the MMM blog, so money has been on my mind. We have cut out a lot of extra spending (no car, don’t eat out, don’t buy new clothes, etc), but still have a ways to go. I know MMM would be absolutely horrified by our grocery budget ($600 a month), but we love food, cook from scratch, and buy local/organic/sustainable when possible, which is important to us. I know we could spend less (clearly, b/c our budget is insane), but I see it as an investment in our health and happiness. I suppose that I justify it to myself since we don’t eat out but a couple of times a year. I started digging in the garden last weekend as we have finally graduated from apartment renters to homeowners. I’d like to think that will save us money, but I know there will be a lot of costs associated with the garden, especially at first.

All of that is to say thanks for bringing a different perspective to the money/budgeting issue. I look forward to more posts this month!

WOW! Erica, your work is so good here, and then there’s the bonus of the comments. I’ve felt like I’ve been on no spend for about two years. The job was gone maybe 5-6 years ahead of the planned retirement date. I hacked 38% off my budget and I keep finding new little tricks to save. My theory was to make as many reductions as possible, find a few “quilt blocks” of income, and avoid going back to cubicle life. It’s working so far. With the exception of no health insurance, all my basic needs are met, and the sacrifices needed seem easier than going back to the cube. My weakness has been sometimes splurging on chocolate or junk food, where the nutrition provided is no where commensurate with the cost. When the craving hits, thoughts of budget go out the window. It might only be $12 to $15 a month. The other thing is gas for a drive to the country now and then, probably an extra $20 or so a month. The drive out of town seems more necessary and better for my health. And if I’d ramp up a bit on the quilt blocks, the splurges wouldn’t matter. I’m excited about checking out the MMM.