I know this isn’t a financial blog, and this post won’t appeal to all readers, but a big part of running any home – productive or not – is money stuff. So, I wanted to share how Homebrew Husband and I have, over the years, honed a kind of financial hierarchy for our savings goals.

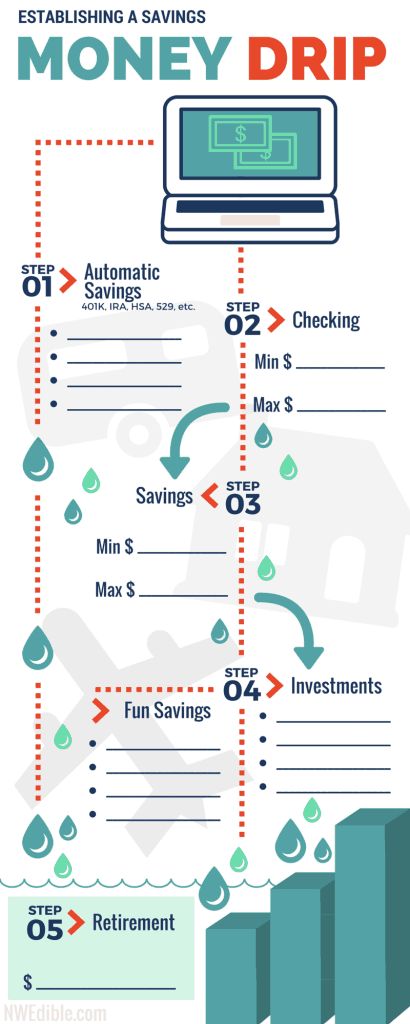

We call this the “Money Drip.” Our goal with this idea is to establish specific target ranges for our checking and savings accounts, so as money drips through those accounts we get and maintain the right amount of money in the right places.

It’s a bit like food. You wouldn’t keep your dried beans in the fridge, or your fresh milk in the pantry. And you wouldn’t buy a huge fridge to hold 97 gallons of milk at a time because that would be excessive. (Okay, some of you with dairy animals would. But you know what I mean.)

So it is with money: some funds are short term like milk in the fridge, and some are longer term, like dried beans in the pantry.

For a while we budgeted by giving every conceivable thing it’s own category – travel, home maintenance, kids activities, emergency, car repairs, etc. This is sometimes called the envelope method of budgeting – we used a program called You Need A Budget – and it’s a great way to get started.

But we realized we needed a simpler system – something that was less work and more flexible but still held us accountable in our savings goals. That’s when we came up with this Money Drip idea.

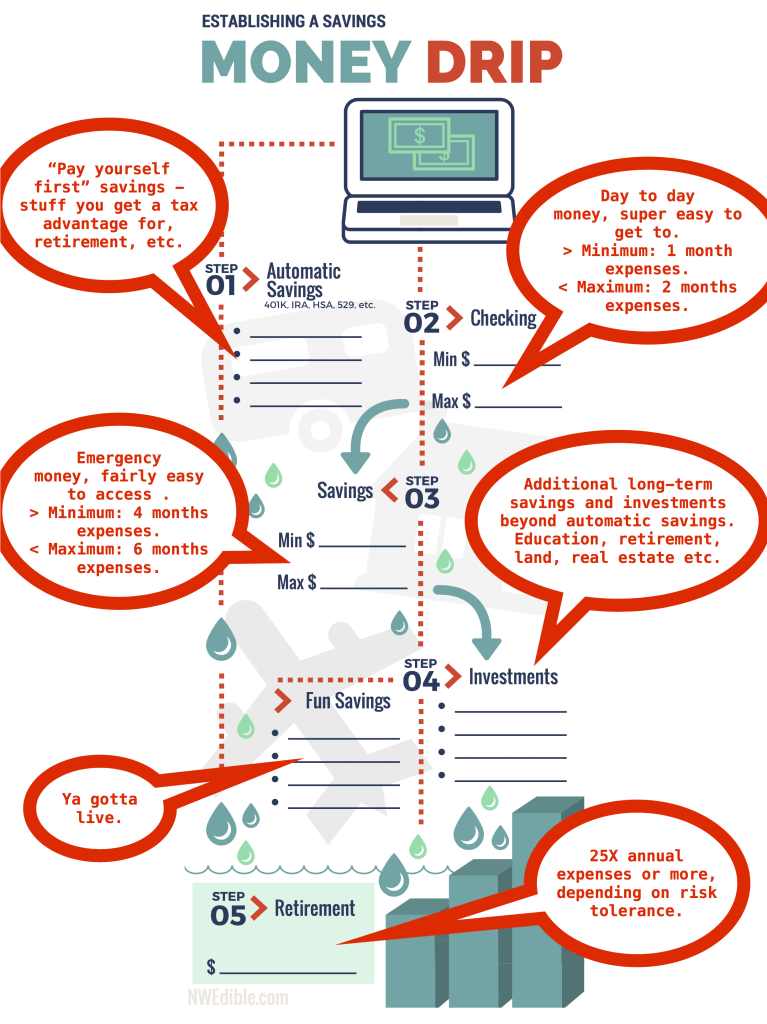

The general idea of the Money Drip, with quote bubbles.

Step 1: Automatic Savings

Savings we try to automate and then forget about. Any savings that snags a tax advantage or a match from an employer should be a priority here. Think 401k retirement, IRA contributions, health savings accounts, 529 education accounts, etc.

Step 2: Checking

Checking is used for day to day expenses so we want the funds here to be easily accessible. (This is the milk in our fridge.)

Checking is the first place that “catches” the money drips, so the minimums and maximums here directly influence how rapidly the money moves down the hierarchy.

We set our checking minimum at basically our Peace of Mind amount. If we spend (or don’t) right, checking never dips below that amount. For us, that’s one month of typical expenses, or – put another way – enough to pay our household bills and pay off our credit card in full every month.

Our maximum is twice that – two month’s typical expenses. Beyond that, for us it’s a bit like having those 97 gallons of milk in the fridge – too much for the short-term holding area of checking.

In between our 1 month and 2 month targets, the checking account just breathes up and down as we pay bills, cash checks, buy chicken feed, get paid, etc.

Step 3: Savings

Once checking is full, money drips into savings.

We view savings as basically a combo short/medium-term emergency fund. These savings are tapped for short term unexpected “emergency” expenses like home or car repairs.

But they also serve as a medium-term savings buffer against job loss or debilitation. If my husband – the primary income earner in our family – were to lose his job, our savings would buffer against the impact of that. Or if I were to fall and shatter my leg, the savings would help with the expenses incurred while I recovered.

This is the proverbial beans in the pantry.

We try to keep a minimum of 4 months expenditures in savings. Our maximum is 6 months. Between these numbers, the savings account can float a bit. If we know we’re going to have home repairs coming up, for example, we might aim to top up savings so that when we pay for those repairs, we don’t dip down under that 4 month minimum.

One thing to note, here: Savings doesn’t necessarily mean money in a bank savings account. Money market accounts or short term certificates of deposit or other short-term, very safe investments might make sense.

Step 4: Fun Savings / Investments

Once the savings emergency fund is full, any additional savings goes to fun stuff like travel, or to additional investments.

I don’t think there’s any right or wrong at this point. Once your money drips down here, it’s already survived long-term automatic savings and rolled past a full checking and emergency savings account.

So you’re saving for whatever you want at this point. Travel? Pay off the house? Buy a boat? Early retirement? That’s your call.

Early retirement was our biggest priority for several years, but now we are directing more of those drips into savings for travel to support our upcoming homeschooling adventure.

Step 5: Retirement / The Long Goal

The little drips that make it to the bottom join with the drips from automatic retirement savings in a pool that will, eventually, fund our retirement.

If retirement isn’t your thing, then just read this as “really, really long-term savings” for a stretch goal that gets you hot and bothered.

Not sure how much you need for retirement? 25 x (your annual expenses) = a nest egg that will support a 4% safe rate of withdrawal. (More info on the 4% rule here.)

This is actually less than financially-conservative types aim for these days, but anyone who can save 25 x their annual spend can probably save 30 x their annual spend, so I think 4% is probably still a good starting place.

Show Me With Real Numbers

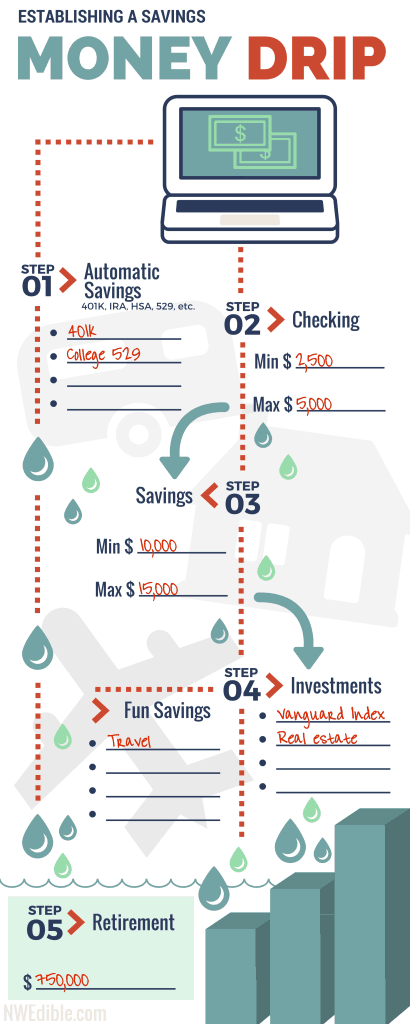

Ok, here’s the Money Drip idea, filled out for someone who spends $2,500 a month on normal, everyday expenses.

- This assumes you aren’t in consumer debt. Specifics vary, but generally you want to prioritize killing off consumer debt, especially high-interest credit card debt, over extensive savings.

- Minimums and maximums are just based on what make sense to us – but we are pretty conservative about stuff like this. You may be more comfortable with a smaller or larger emergency fund, for example.

- Savings based on months should be based on how much you spend per month, not how much you make per month.

Printable Money Drip Savings Chart

This Money Drip concept has worked really well for us for several years. It’s granular enough to help us categorize our savings, but not so granular as to make savings seem like a bunch of work.

I’d say it’s helped me, especially, get my head around a lot of basic savings concepts. What can I say – I’m a visual learner.

Here’s a PDF of this chart – a blank version of what I designed for myself. Feel free to print it out, fill it out with your numbers and specific goals.

Thanks to anyone who made it this far! Happy savings! And now, back to our regularly scheduled programming…

0

This is, sadly, very confusing to me. And that is not a good thing to admit. As a military-retiree wife I guess I belong to a family of two and we should only need to plan for our elder years. (?) We have no travel goals because we have elder parents who need us here and also a young grandchild that we want to stay close to, so no big travel plans. Still….we have no consumer debt and are only working towards paying our mortgage and building our savings. It would make a lot of sense to divide into categories like you have. Thank you for the very thought-provoking post.

Sounds like you are in a good position, being debt free except mortgage. If you are already at or near the retirement stage, and with a military background, I’d guess there is some sort of pension/defined retirement benefit? That kind of benefit plus Social Security can make a big difference in reducing what is needed for retirement savings

Hmmmm. Goats seem to be missing as a category.

I’m just gonna pencil them in between each of the other lines. That should work, right?

Savings, goats, investments, goats, fun, goats.

This is a very good plan!

Nah, goats can be right up there in “everyday expenses” – just like chickens! 😉

My husband and I also moved from using YNAB to track every last purchase to a more simplified approach like this. YNAB gave us a fantastic perspective on where all our money was really going and helped us shape our now ingrained purchasing habits.

We have our 401k set up and a line of credit that acts as our ‘long term savings’ (because we are aggressively paying off 85k in student loans). I run all day to day purchases through a credit card and every paycheck I pay off the credit card in full, look at what recurring bills are coming up, and put everything past 1,500 from my checking onto loans.

I cannot wait for the day we can say we are debt free!!!

Excellent post! I don’t think you ever need to apologize for a topic outside of the normal gardening/cooking/homesteading. All of these topics (including money) link together to form out lives and none of them live as a closed system from each other.

I love your system. You’re gonna have those student loans paid off asap. I think the use of the LOC as a deep emergency fund makes a ton of sense in your case – security without slowing down on debt repayment. Thanks for your kind words. 🙂

This is really good! Thanks for posting! In particular, I’ve often wondered what the right amount is to save for retirement. 25x annual spend makes sense. I love the range of topics that you post!

Erica’s the real expert on retirement savings goals (I tend to just trust her numbers and say “uh huh”) but I do think it is important to think about what sort of retirement you want to have (global jet setting, quiet volunteering at the library, self-sufficient cabin dwelling, etc.) and what sort of world you expect to retire into (post-apocalyptic zombie fest, booming global economy, fading twilight of hegemony, etc.).

Claudette, if you wanna have some real fun with retirement calculations, check out Firesim or FireCalc. Both are not the greatest UI but fun, fun, fun for financial data visualization.

I’m always interested in how other people handle their money – it’s fascinating! We do something pretty close to your method. In our house we keep track of spending in broad categories monthly, keep a year’s worth of cushion, spend on a big trip each year and then smaller travel adventures throughout the year, and then pump as much as possible into retirement. We were trying to pay off our house more quickly, but then decided it was better to focus on retirement for awhile instead. Our mortgage balance and rate are pretty low. I find peace in paying attention to my money – it’s comforting to know how much we need to live on and how much we have! We always, always live far beneath our earnings and that feels good!

“I find peace in paying attention to my money.”

Totally this!

Right now, with kids getting older and me, frankly, getting twitchy about seeing something new, we are shifting from very retirement focused to more adventure focused – it’s great to hear that you prioritize travel while still saving.

I really like the graphic you designed.

Funnily enough I have made the opposite transition, though. I used to use a method similar to your Money Drip but actually prefer a more detailed system like YNAB especially since we do have debt and the future budgeting allows me to really easily know how aggressive I can be towards the debt without having us run out of money for day to day.

Thanks David. Yeah I don’t see this at all as a one-sized-fits-all thing. In your situation it makes total sense to destroy debt at rapidly as possible, which means keeping everything tighter than this allows for.

Thanks for sharing this! You’re absolutely right – financial savvy is a huge part of managing a household and I don’t think we talk about it enough! This post fits perfectly with your blog’s mission.

I’m such a fan of budgeting and financial planning. It’s feel so good to control your money, instead of allowing it to control you! When I left the workforce 9 years ago to become a stay-at-home parent, we quite literally cut in our income in half. I kept running the numbers and could not figure out how we would survive. But we did – sometimes money would just show up in the mail – exactly the amount we needed. I learned to budget and plan like nobody’s business, and instead of feeling scared and overwhelmed, I felt empowered.

9 years later, we have paid off $16,000 of student loans, saved 6 months worth of income, made major house repairs, bought new vehicles (with cash we saved up), made significant investments in retirement, and we’re able to pay 4 extra house payments a year. We’re 35 and debt free, except the house… and we’re on the fast track to pay the house off 12 years early. I credit all of this to the beauty of budgeting! If I can do it (I’m an artsy fartsy person who’s eyes cross when I see numbers), anyone can!

I love how you shared a great option for people who feel a little smothered by the “envelop system”. It IS a great tool that helped us immensely, but I can see it is not for everyone.

Thanks for all your great work!

This…

We’re 35 and debt free, except the house… and we’re on the fast track to pay the house off 12 years early. I credit all of this to the beauty of budgeting! If I can do it (I’m an artsy fartsy person who’s eyes cross when I see numbers), anyone can!

…is SO impressive! Great job! I totally agree about the emotional component of financial planning.

This is a great way of prioritizing your money flows. How do you use this to manage your monthly spending? Do you stop spending when the checking account falls below the one month threshold?

More or less, yeah. Our bills are pretty predictable at this point in our life. What happens is, I have a good idea how much my credit card payoff and monthly bills are. If my checking account starts to approach that one month threshold, it feels like my account is nearing zero. I basically have a financial panic attack and we just stop spending on anything discretionary, even though of course there’s a couple thousand dollars of buffer in the checking account. Responding early, before there’s really a serious issue, is a bit like cutting back on dessert when you’ve gained 2 pounds, instead of waiting until you put on 30 pounds and then going on a major diet. It doesn’t take long to get back within a comfortable “tolerance” – usually just one paycheck. But I’m pathologically uncomfortable with debt – not claiming this is the “right” system, just that it works for us.

I’ll also add that we used YNAB and a few other methods of more precisely tracking our expenses, off and on, for a number of years. While they proved too fiddly to stick with in the long term, I think the exercise did a lot to help build a “feel” of our typical spending habits. So now it is pretty easy to have a sense of having been spending more or less than usual.

Thanks for the response. It is great to learn everyone’s methods for managing money. I’ve picked up a few great tips.

I always love a post about money. We follow something very similar. The key to success for us is to have it automated. We use CapitalOne360 accounts for short-term savings. Every time a paycheck hits our account a percentage is automatically timed to transfer into our savings. That way we’re not tempted to spend our savings before it gets put away. A huge one for us is setting up automatic savings accounts like that for large expenses. For example, we knew we needed a new kitchen counter and the quote we got is for $1500. We were able to put away $10 per paycheck, and I set up calendar reminder 3 years later to say “counter fully funded!” There is zero guilt associated with spending that money. We probably have 10 accounts that we’re saving for set up like that from big family vacations to wedding rings and new cars (pay cash for a car?! Easier than you think). The piece of mind alone is worth it!

Ok, I may not know much about how to turn my acre into a permaculture paradise, but I do know a fair bit about finance. This is quite good. The one thing that I would *STRONGLY* recommend to everyone is to develop a relationship with a financial advisor. This relationship is probably not what you think it is. This person can be a trusted advisor that can help you achieve all of the aspects of your Money Drip chart, keep you on track, and give you permission to feel good about my choices.

When my sweetheart of seven years walked out, I turned to my financial advisors. We put together a new financial plan that left me better off and happier than I had been before.

When I wanted to make a *big* fun purchase, they helped me give myself permission to enjoy every moment of it. I have.

When I started to recently be nervous about my future based on things happening in the economy, we sat down for an hour and talked about what was reality and what my anxieties were *actually* about. They were about a change in my professional life, not about the economy.

Don’t underestimate the power of having an advisor in your life to help with all of these choices. Having someone you can turn to who is not a friend, family member, or the internet can have a huge impact across your entire life.

We have had a financial advisor for about 6 years now, and it has been really helpful. I agree that the relationship you have with one is not what the stereotype might portray. Our advisor has helped us get great life insurance, get our multiple 401K accounts consolidated, manages our IRAs and is currently helping us get good disability insurance for my husband. He has helped us with our long-term financial goals, and we have a great relationship. I trust this guy!

Love this post! I’m so with you that it isn’t one size fits all, but find what works for your family. We consider our checking just a temp holding place as we pay bills. All $$ goes into our money market, which is also our emergency fund account. As that builds we fund our Roth IRAs and do other investing. We do a paper income/expense sheet throughout each month (yes, paper!) and I’ve got years of these built up so we can compare year over year and month over month. It is old fashioned, but it works for us and that is what is important.

We’ve always been frugal and it has served us well being totally debt free in the home we play to raiser our family in and then retire in a few decades from now. Recently my husband’s parents passed away and we’ve been dealing with their estate and some inherited money that we never expected. To second the rec for a good financial advisor we are finding ours to be more important than ever as we deal with this. It isn’t life changing money, but it moves us closer to our investment goals and also gives us money to accomplish goals quicker than expected. He has encouraged us to spend some doing these things (installing wood stove, custom bookshelves/homeschool room finishing, long term food storage) because they were on our list and we have extra resources. For those of us who are crazy frugal sometimes it takes an outside opinion to realize you can spend on the NOW and not always just think of the someday. Okay, enough rambling, but I love that you talked about this!

We use a zero sum budget – every dollar we earn each month is given a purpose. This includes household expenses, shopping funds, vacation funds and retirement savings. I used to be *terrified* of the word budget – but I am now a huge advocate. Being in control of your money actually gives you more freedom. No more guilt when we purchase a large item – because we have the money saved for it.

We use Dave Ramsey’s Every Dollar app and website to update/edit our monthly spending on the go so that we have an accurate picture by the end of the month.

OK, you may not like me here yet again with my blah, blah, blah, but going to say this anyway.

You rock. Mostly because I felt this was the type of advice I should be dispensing many years ago online, but I really feel that people should be free to follow their own paths regardless of what “wisdom” you & I & others may have to the opposite.

(“wisdom'” in quotes because … well, because… everyone’s background, current situation & circumstances are different…)

You will likely meet me oneday, but probably never know me!

Insert evil laugh… If I but had one!

Wait, you have an upcoming adventure in home-schooling?

I have no kids, but I totally want to know more!

How do you know when to move money to the next “bucket?” As soon as the number hits the maximum? What if you move a bunch of money from checking then the bills hit? I’m asking seriously, as I have struggled with how much to keep in my checking. I understand this in theory, and do a very similar thing without even realizing it, just wondering how you do it in practice.

I like your system and it meshes with what I recently concluded about our own finances — I was spending way too much time moving cash around to make a few pennies a year in interest. I was also starting to obsess a bit about every little decision (despite a 50% savings rate) instead of “going with the flow.” Your system is practical. And the graphic is helpful. You’re a very good teacher — especially for visual learners like me.

Keep on keepin’ on. I love this site, and your book.

Thank you so much for posting such a clear but illuminating budgeting strategy!! It really helped my thought process regarding saving money and then infographic looks fantastic. I actually have it hanging on my wall to help me stay on track!