I spent most of my post-college years with a checking account that was perpetually overdrawn by $300. I once went on a three-week trip to Scandinavia and spent the entirety of my food money on my first dinner outside of the U.S. In my defense, food in Reykjavik during the holiday season is unbelievably expensive. Due to what I can only describe as phenomenal good luck I didn’t happen into a credit card until after I got married, which probably spared me a lot of long-term debt-related problems.

Homebrew Husband’s actually worse with money details than I am. When we were engaged the lights were shut off in his home because he hadn’t paid the bill. This is not because he couldn’t afford the bill; he had a good job and was living within his means. No, he just sort of…forgot…to pay the bill for three months.

I say this to establish that neither of us are natural accountant types who imput their purchases into Quickbooks nightly before retiring to bed. We are both slightly scattered, creative, project-oriented people who have to work to keep our shit together.

And yet, I am pleased to say, our financial house is pretty much in order. It took many years of home systems development to get to this more-or-less happy place, and quite a bit of good fortune to boot. (And I am right now knocking on some nearby wood, in case you were wondering what that thumping noise was.)

So this is what we’ve learned, and this is the system we use to keep our urban homestead in the black. What works for us may or may not work for you. Take what seems like it might be useful; above all what we’ve learned is that the home system has to really fit the people in the home.

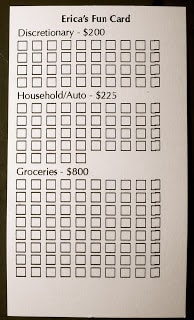

We keep track of our spending with a tool we designed that we call the “Fun Card.” We call it that because so little about budgeting seems fun when you start doing it that we wanted to emphasize that this little card was a tool that enabled us to have fun. Our fun cards look like this:

The Fun Card is check box system, custom designed for our monthly budget. You can pretty much see our monthly numbers above; revealing that info publicly is a point I debated heavily, so please no one be a jerk and make me get all defensive about what our budget numbers are and how we arrived at them.

You’ll notice it does not include the recurring costs like water, electricity, etc. that we have proportionally less control over. The point of this tool is to keep our day-to-day expenses in-line. It’s not fancy – it’s printed on make-your-own business card paperstock and anyone could easily make their own in MS Word or Pages.

Whenever we buy something, we check off an amount on our Fun Card equivalent to what we spent. On my card, boxes under “Groceries” are worth $10; other boxes are worth $5. I will split boxes if something is right in the middle, X-ing out a box-and-a-half for a $7.50 purchase.

If we fill up the tank, we check off $50 or $80 from the “Household/Auto” category. If I stock up on our salmon for the year, I might check off $400 from the “Grocery” category. If I go out for coffee with a friend, $5 comes off the “Discretionary” category. Garden stuff is still trying to find a happy home. Some garden stuff is, to my mind, obviously discretionary, but some, like seeds, gets booked against “Groceries” because that’s really what we’re buying.

That’s it. A simple tool designed to be kept in our wallet, used discreetly and give us at-a-glance monitoring of our monthly budgeting success. And for us it really works. When we started using the Fun Card we cut our non-essential spending in-half.

Next week I’ll tell you about our advanced Fun Card Techniques: the carryover, the touchbase and the reconciliation.

How do you keep track of your spending?

—–

This is a great idea! I'm probably a little closer to the type you mentioned in your post. I don't use Quickbooks, but I use a system called "Budget for Windows". It has cute little envelope icons and everything. I update once a week. If it's a heavy-spending week, then maybe I'll update twice.

The important thing, I think, is finding the tool that works for your family. I'm looking forward to hearing about your "advanced Fun Card techniques".

I like it! And I like budgets about as much as I like diets, although I'm very frugal. I use Quicken to manage our finances, but I could see something like this still being a useful tool for us. Thanks for sharing!

I am a Quicken freak–but I still like to implement and use new ideas like these—this is a great idea for people who have a hard time remembering what they spend.

I put $400 cash in my wallet at the 1st of the month. That's gas, groceries and discretionary for me.

It does not include birthday and Christmas gifts for the grandkids 🙂

When the $400 is gone – that's it for the month. Still works well.

PS – Very unique account keeper! I like it – and more importantly, it works for you!

Hmm. I could get into this. Seems much more feasible than actually writing every single thing down. I assume you round if something is say, $6 or $9?

Also, since I am lazy, I don't suppose you'd like to share that file template, if it's in Word? 🙂

Chris – It's in Pages, but I think I can save to Word format. I'd be happy to share the file but my computer is having it's hard drive replaced (thank you extended warranty). I should have it back by next Friday, I'll figure out how to share the template on next weeks Frugal Friday post. Good idea, thanks.

I love this! What an easy way to track expenses.

Great way to stay on track. Well done. I personally don't spend money if I can help it. Sure we spend a similar amount on household and auto every month, as well as groceries, but it's discretionary spending and one-time events that get us. I track them from the online credit card site and review everything significant with my spouse. If we weren't good at living within our means this would be the tip of the iceberg. hehe.

I love this idea. I'm pretty good with a budget, but discretionary spending is always an issue around our house and I've had trouble keeping track of it since I don't always have control over what the hubby is spending. This looks like it would be a great tool for us. Thank you, thank you.

I totally love your Fun Card. It's so much more my style than Quicken or whatever – but that's what the hubs uses and I'm used to it and actually keep a better eye on things than him .

Let me know if you figure out where to put garden stuff… that's always our big debate too. Like seeds and plants in "Groceries" I get, but what about drip hose or tomato cage wire or… Sigh. I think we usually just put ours in "Household" or maybe "Home Improvement" since those things last a while??

I love this! And I'm really looking forward to next week's post! I rather need to overhaul the way we take care of our family's financial system.

This is a really cool idea. I've found, however, that no amount of writing on a piece of paper will keep me from spending the money if I want something so I use the good ole cash in an envelope method. Nothing say's "don't buy it, you don't need it" like seeing that you only have $200 in grocery cash and it has to last for another 3 weeks.

My hubby and I are trying so hard to budget. It’s so difficult – we’ve got 20 years of bad habits under our belts. It’s especially difficult when those unexpected (but probably should have been) school expenses like band uniforms rear their ugly heads.

We are using an App called Mint on our iPhone/iPad and desktop. I like it, but it still requires checking in and keeping an eye on what’s going on. I did discover that it has a ‘pending’ category for checks which my online banking doesn’t have, and that’s helpful.

So, I have two questions for the ‘budget masters among you.’

Do we deposit the whole check then take out the $300 for groceries and track how we spend it separately (maybe on Erica’s punch card which i like btw)? Or do we do ‘less cash recieved’ when we make the deposit so our account never ‘sees’ that money. In Mint – and maybe i need to post this on Mint – it seems like if I deposit, then withdraw it, then record expenses as ‘cash’ it will look like double deductions from our spending. Where if the checking account never ‘sees’ the money, we’re spending cash and spending what comes out of our checking account (fixed expenses) without confusing/mingling the cash and the checking. (Sorry if you can’t answer because you don’t understand what I’m asking. I know it’s confusing.)

My other question is, if you have backyard chickens, do you count their feed a pet expense, or a grocery expense? The feed comes out as eggs… So I’m leaning toward grocery, but I’m curious what others’ do.

I wish this was an app! That would be so perfect!

I know this post is from 2011, so I’m a bit late here, but I just want to say that THIS is going to be my new way to keep up with tracking my spending. I currently have a spreadsheet where I list everything from receipts, which went well for about 2 weeks then I lost track of something and gave up again.

But this is on paper! I can use a colored marker.